Former Roots Party’s Deputy Leader Justina Wamae has come out strongly to call out I&M Bank Kenya following allegations raised by city businessman Paul, popularly known as Ouma_Neko on X.

Through her Facebook page on December 27, Wamae shared a screenshot of Ouma Neko’s viral posts detailing his alleged ordeal with the bank.

In her message, Wamae questioned what she described as a troubling obsession with scrutinising wealth while ignoring the realities that push many Kenyans into financial distress.

“I cannot confirm the veracity of this post, but my question is, why is everyone else concerned about one’s source of wealth, yet they are never concerned about one’s source of poverty?” Wamae wrote on Facebook.

A photogrid of businessman Ouma Neko and I&M Bank entrance.

Her remarks come as public debate continues to swirl around Ouma Neko’s claims that I&M Bank Kenya froze his account holding close to Ksh 5 million shortly after he withdrew Ksh 2 million from his business proceeds.

According to the businessman, he had moved between Ksh 7 million and Ksh 13 million through the account over the course of the year.

In his X posts, Ouma Neko alleged that the account freeze came without prior notice and at a particularly difficult time, during the December festive season and ahead of January school fees.

He claimed he was subjected to repeated delays and taken “in circles” between bank staff and managers despite complying with requests to explain the source of the funds.

“I’ve banked with I&M Bank for years, and this year alone, I moved roughly Ksh 7–13 million through my account.

“Without warning, my account was frozen with close to Ksh 5 million locked inside,” part of Ouma Neko’s statement reads on X.

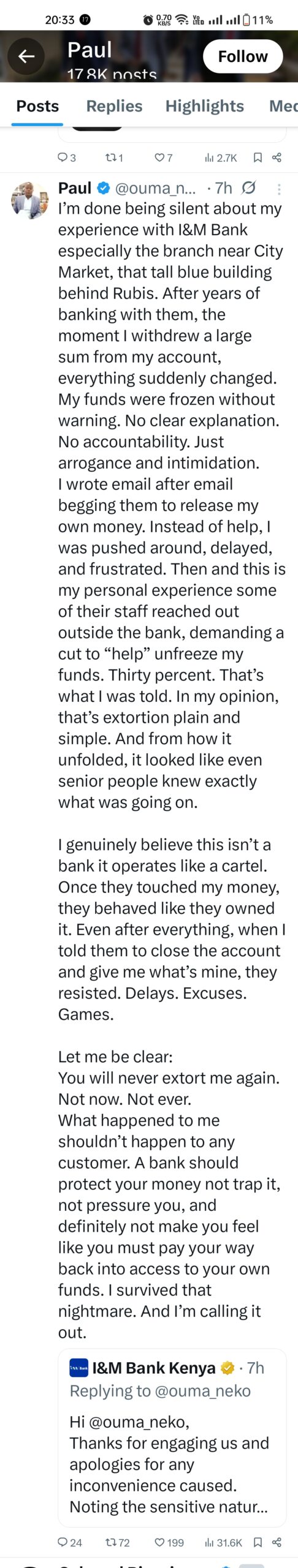

A post on X by Paul Ouma Neko exposing I&M Bank Kenya. Photo: Screenshot by Kenya Digest

He further alleged that matters escalated after he involved a lawyer, claiming that he was later approached outside the bank and allegedly told his account could be reopened if he surrendered 30 per cent of the balance.

“Think about that. Thirty per cent of my own hard-earned money,” he wrote, describing the demand as extortion.

Wamae’s intervention reframed the debate beyond one individual’s experience, arguing that institutions and society at large often interrogate success while overlooking systemic issues that perpetuate poverty and vulnerability.

Her post resonated with many online users, some of whom argued that while banks are required to comply with anti-money laundering regulations, customers also deserve transparency, dignity and timely communication when their funds are flagged.

I&M Bank Kenya has since responded publicly to Ouma Neko, apologising for any inconvenience caused and stating that holding of funds can occur due to compliance and regulatory checks, while requesting further engagement through private channels.

However, as the discussion grows, Wamae’s comments have added a political and social dimension to the controversy, amplifying calls for accountability and fairness in how financial institutions handle customers, particularly during moments of financial pressure.