I&M Bank Kenya is at the centre of a brewing financial scandal after a city businessman accused the lender of freezing an account holding close to Ksh 5 million, shortly after he withdrew Ksh 2 million from his business proceeds.

Businessman Paul, who goes by Ouma_Neko on X, has taken to the platform to detail what he describes as a troubling ordeal with the bank, claiming that despite having moved between Ksh 7 million and Ksh 13 million through the account within the year, his funds were abruptly locked without warning.

In a series of posts, Ouma Neko alleges that the freeze triggered weeks of frustration, with the bank citing compliance issues even after he provided proof of the source of the funds, a process he says confirmed the money was legitimate.

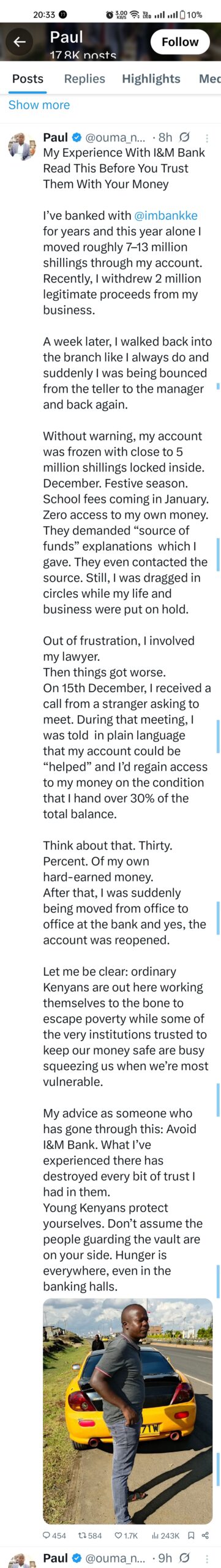

A post on X by Paul Ouma Neko exposing I&M Bank Kenya. Photo: Screenshot by Kenya Digest

He says the freeze came without warning, at a time when he urgently needed access to his money during the festive season and ahead of January school fees.

He alleges that what followed was a cycle of delays, confusion and intimidation.

In one of his initial posts, Ouma Neko wrote:

“I’ve banked with @imbankke for years, and this year alone I moved roughly 7–13 million shillings through my account.

Recently, I withdrew 2 million legitimate proceeds from my business… Without warning, my account was frozen with close to 5 million shillings locked inside. December. Festive season.

“School fees are coming in January. Zero access to my own money,” part of Ouma Neko’s statement reads on X.

He claims that when he sought answers, he was moved between tellers and managers without clear communication.

Eventually, he says, the bank cited compliance checks and demanded proof of the source of funds.

A post on X by Paul Ouma Neko exposing I&M Bank Kenya. Photo: Screenshot by Kenya Digest

However, he maintains that he fully complied and that the bank even contacted the source and confirmed the funds were legitimate.

Nevertheless, Ouma Neko alleges that the situation escalated after he involved his lawyer.

He claims that on December 15, he was contacted by a stranger who asked for a meeting outside the bank. During that meeting, he says he was given a shocking condition for help.

“I was told in plain language that my account could be ‘helped’ and I’d regain access to my money on the condition that I hand over 30% of the total balance,” he wrote, adding, “Think about that. Thirty. Percent. Of my own hard-earned money.”

According to him, his account was later reopened after what he describes as intense pressure, though he insists the experience shattered his trust in the institution.

He further accused some staff of operating with impunity and alleged that senior figures were aware of what was happening.

“In my opinion, that’s extortion plain and simple. And from how it unfolded, it looked like even senior people knew exactly what was going on,” another part of his statement reads on X.

In response to his complaints on the platform, I&M Bank Kenya issued a brief public reply, apologising for the inconvenience and citing regulatory compliance.

The bank asked him to share details via direct message, noting the sensitivity of account information.

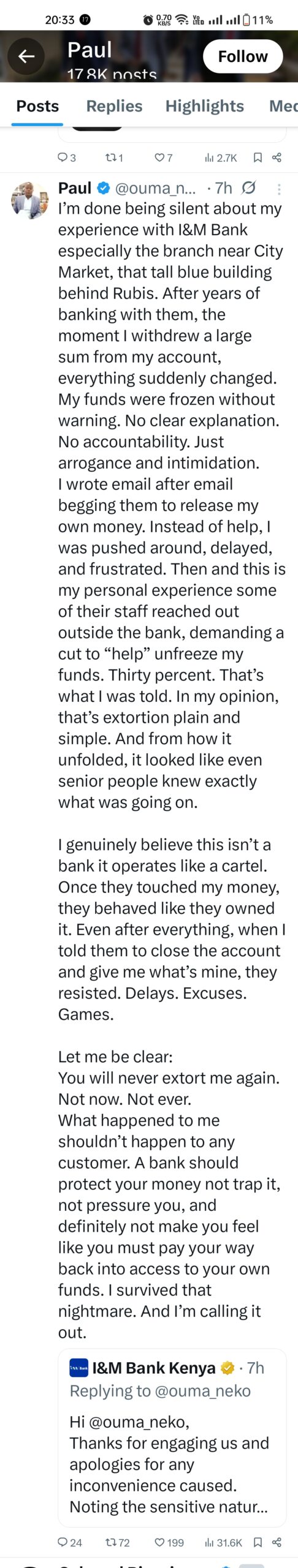

A response by I&M Bank Kenya to Ouma Neko on X. Photo: Screenshot by Kenya Digest

However, Ouma Neko dismissed the response and doubled down on his claims, stating:

“I genuinely believe this isn’t a bank; it operates like a cartel… A bank should protect your money, not trap it, not pressure you, and definitely not make you feel like you must pay your way back into access to your own funds.”

While the bank has not publicly addressed the specific allegations of extortion, the claims have sparked debate online about customer protection, transparency and accountability within financial institutions.

Meanwhile, Ouma Neko says he is speaking out so that other Kenyans, especially young entrepreneurs, can be cautious when trusting banks with their livelihoods.