Tullow Oil, the well-known British company involved in oil and gas, has decided to leave Kenya after years of trying to help the country become an oil exporter.

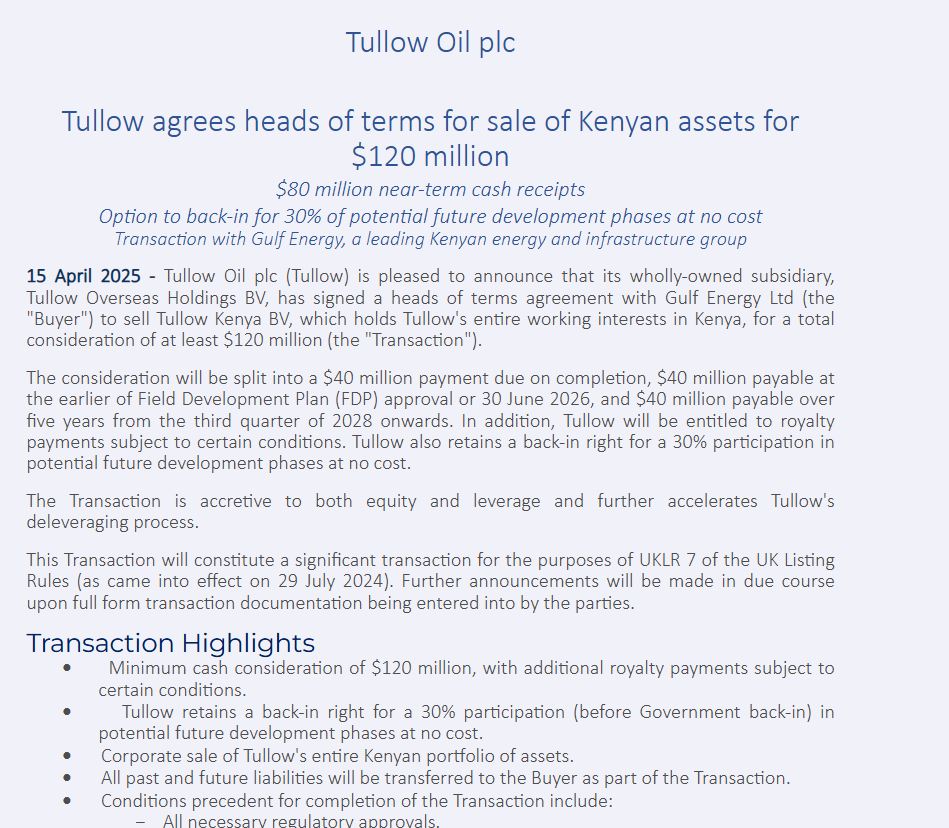

On April 15, the company announced it will sell its Kenyan oil assets to Gulf Energy Ltd in a deal worth around Ksh16 billion, or about USD 120 million. This decision comes as Tullow aims to reduce its growing debt. The deal allows Tullow to receive the money in stages, with instalments of Ksh5.3 billion each, eventually totaling Ksh15.9 billion.

One of the key advantages for Tullow in this deal is that it will still get future payments based on oil production royalties. That means the company could still make some profit if Kenya’s oil production improves in the future.

Additionally, Tullow will remain involved in future developments in Kenya’s oil industry, but without having to spend more money.

This move marks a major change in Kenya’s oil journey. The country had hoped to become an oil-exporting nation, but progress has been slow. Tullow’s exit may now be a big blow to that dream.

One of the main reasons Kenya has struggled in this area is because of weak infrastructure. For example, there is no fully functional pipeline to move oil from Turkana, where the oil is found, to the coast for export. Without that pipeline, large-scale oil production and export is very difficult.

Tullow’s decision to leave may also be due to the heavy losses it suffered while operating in Kenya. Reports show that the company lost Ksh19 million during its time in the country.

After 2023, Tullow was left as the only owner of the Lokichar oilfield, having previously shared ownership with other international partners.

Operating alone likely increased their financial burden since the costs were no longer being shared. Before making this final decision, Tullow had been negotiating with Indian government-owned companies about possibly selling the assets to them. However, those talks did not succeed.

It seems that the decision to sell the Kenyan assets is part of Tullow’s bigger plan to clean up its business operations. Earlier in March, the company sold its oil interests in Gabon for Ksh39 billion, showing that it is reducing its presence in several African markets.

Now, with Gulf Energy preparing to take over, there is still some hope for Kenya’s oil future. A new player in the market might bring better strategies and possibly more investments. But for Kenya to truly benefit, the focus must shift to building the right infrastructure like pipelines and storage systems.

Only then can the country revive its dream of becoming a serious oil exporter and take full advantage of its natural resources.